What Is Concentration Risk in Affiliate Marketing and How to Prevent It

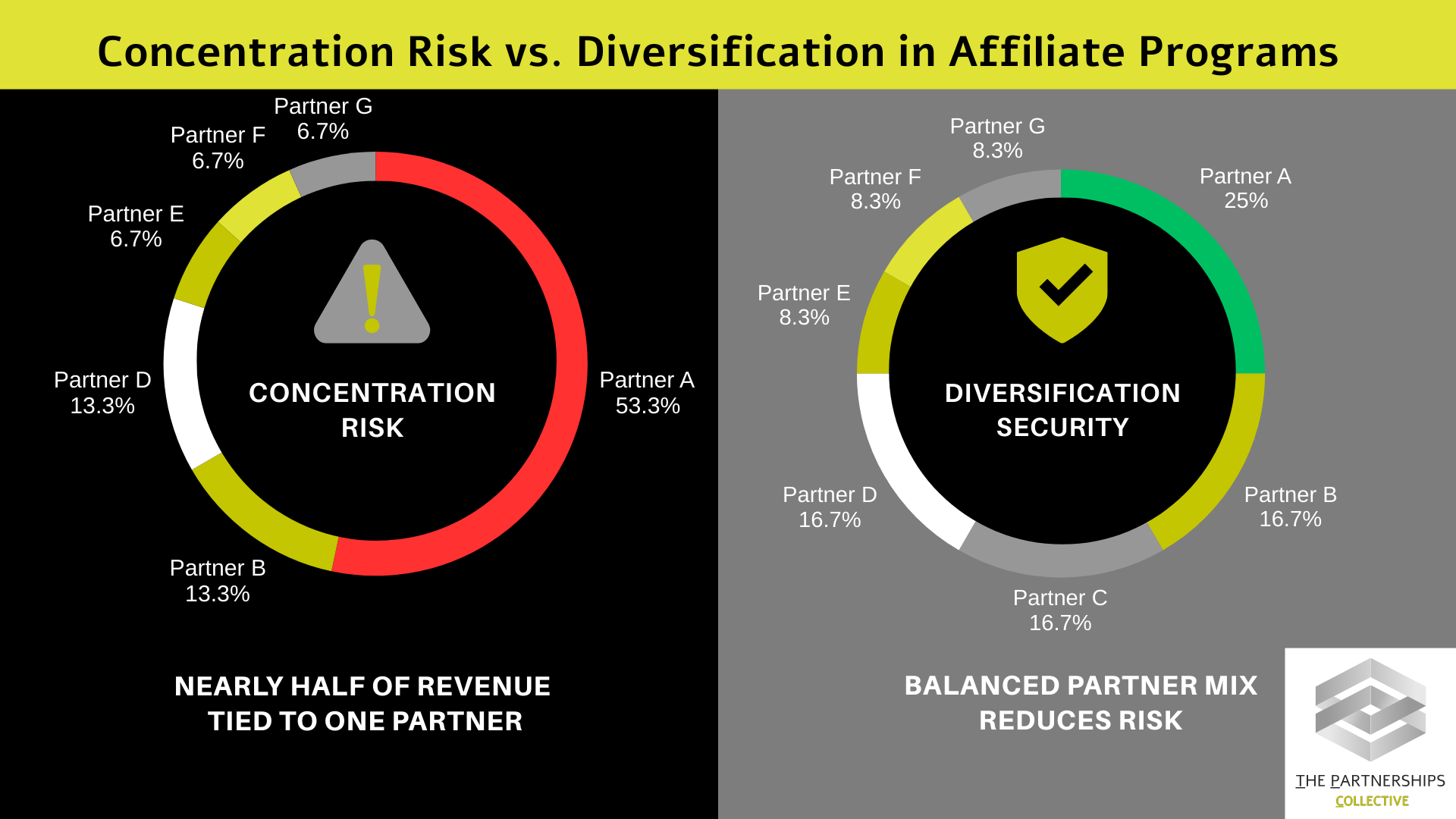

Every affiliate program manager knows the thrill of finding a high-performing partner. But what happens when one partner drives most of your traffic, sign-ups, or funded accounts? That imbalance is called concentration risk and it can quietly undermine even the fastest-growing affiliate program.

In this article, we’ll break down what concentration risk means in affiliate marketing, why it matters, and the steps and tools you can use to prevent it.

What Is Concentration Risk?

Concentration risk occurs when too much of your program’s performance depends on a single partner, subnetwork, or traffic source. If that partner changes strategy, reduces spend, or demands higher payouts, your entire channel can stall overnight.

In affiliate marketing, concentration risk shows up as:

One partner generating more than 40% of total conversions or revenue.

Heavy reliance on a single traffic type (e.g., coupon sites, mobile subnetworks, or paid search arbitrage).

A limited number of affiliates contributing meaningful funded accounts.

It’s the equivalent of having one stock dominate your investment portfolio: great while it’s up, painful when it dips.

Why Concentration Risk Matters

Affiliate programs with high concentration face several challenges:

Volatility: Revenue can swing sharply if the partner underperforms or goes elsewhere.

Pricing leverage: Partners know their value and may demand higher CPAs or flat-fee bonuses.

Compliance exposure: A disclosure misstep or brand safety issue from one dominant affiliate creates outsized risk.

Growth ceiling: Over-reliance caps scalability and makes the program less attractive to new partners.

How to Spot Concentration Risk in Your Program

The first step is measuring partner diversity. Key diagnostics include:

Partner share of revenue: Look at the percentage each affiliate contributes to total funded accounts.

EPC distribution: Identify whether EPC spikes are tied to one or two partners.

Funnel breakdowns: Track performance from install → active → funded by partner.

Traffic transparency: Validate whether the partner discloses where traffic originates.

Recommended Tools for Detection

Affiliate platform reporting: Breaks out performance by contract group, partner, and funnel stage. Useful for real-time performance splits and EPC analysis.

Affistash: Monitors partner activity and flags anomalies across multiple programs.

Custom CAC calculators: Build simple models (Excel, Looker, or in-platform) to see how partner proposals affect channel-level CAC.

How to Prevent Concentration Risk

Set diversity thresholds

Make it a goal that no single partner exceeds 30–35% of total conversions. Use this as a north star when recruiting and allocating budget.

Recruit within similar categories

If one subnetwork or app partner performs well, test competitors with similar inventory. Offer walls, mobile DSPs, or additional in-app placements can replicate results without dependence.

Layer in content partners

Balance paid-heavy affiliates with content creators, SEO-driven publishers, and niche influencers. They add stability, compliance-friendly reach, and brand lift.

Test hybrid compensation models

Use a mix of CPA, CPC + CPA, and performance bonuses. This opens doors to partners who won’t work on pure CPA while keeping CAC targets intact.

Invest in partner activation kits

Give new affiliates plug-and-play materials like comparison tables, counter-messaging against competitors, and pre-approved creatives. The easier you make it, the faster they ramp.

Monitor early signals

Don’t wait for revenue dips. Watch EPC by partner, install-to-active ratios, and time-to-funded account. These KPIs show whether diversification is working before losses materialize.

Concentration Risk Is Preventable

Your Affiliate program thrives on partner diversity. A top-performing partner is valuable, but true resilience comes from building a balanced mix of traffic types, compensation models, and verticals. By treating concentration risk as a measurable, preventable issue, brands can protect growth and avoid being held hostage by a single relationship.

FAQ

-

A good rule of thumb is to keep any single partner under 30–35% of your total conversions or revenue. This creates room for performance diversity and protects your program if a top partner changes strategy or reduces traffic.

-

Run performance reports by partner, breaking out funded accounts, EPC, and funnel stages (install → active → funded). Tools like Impact reporting, Affistash, or built-in network dashboards (Awin, CJ, Rakuten) make it easier to spot over-reliance.

-

Fintech programs carry compliance and brand safety risks. If a dominant partner violates disclosure rules or promotes with misleading claims, the brand may face regulatory scrutiny. Spreading performance across more compliant partners reduces exposure.

-

Start by recruiting in adjacent categories to your top partner (e.g., additional in-app subnetworks, DSPs, or content creators). Offer hybrid compensation models and supply activation kits to help new partners ramp faster.

-

Affiliate platform reporting: Breaks out performance by contract group, partner, and funnel stage. Useful for real-time performance splits and EPC analysis.

Affistash: Monitors partner activity and flags anomalies across multiple programs.

Custom CAC calculators: Build simple models (Excel, Looker, or in-platform) to see how partner proposals affect channel-level CAC.